Economic conditions matter. Inflation increases what we pay for everything from food to houses. When unemployment is high, some of us do not have a job. And low economic growth makes it harder to get promoted or gain a higher salary. The question is, how much can (and should) the government do to ensure a Goldilocks economy — one with low inflation, strong economic growth, and low unemployment?

What Are The Main Approaches For Managing The Economy?

There are two main theories of economic policy making. One school of thought, labeled here as the Keynesians (after the economist John Meynard Keynes), believes that governments can and should use fiscal and monetary policy to move things closer to the Goldilocks ideal. The other school of thought, labeled here as Laissez Faire (a French phrase meaning “let it be”), argues that efforts to control the economy do more harm than good, and that the economy works best when it is allowed to operate with minimal government intervention.

Keynesians believe that aggregate demand, or the total money spent by households, businesses, and the government, is the driving force behind the economy. Keynesians argue that low demand leads to high unemployment and low economic growth. To increase demand, Keynesians propose policies such as deficit spending – spending more than the amount collected in taxes – and reductions in interest rates. The aim is to increase demand, which in turn will lower unemployment, increase economic growth, and reduce inflation.

The other common economic school of thought is called Laissez Faire or Monetarists, whose principal proponents include economists Fredrick Hayek and Milton Friedman. Adherents to this school of thought believe that growth, unemployment, and inflation are all driven by changes in the money supply. Followers of the school believe that the government should intervene as little as possible in the economy. They argue that poor economic conditions such as low growth, high unemployment, or high inflation are self-correcting, and that government efforts to mitigate these problems only cause more harm. For example, if the government engaged in deficit spending to stimulate demand, this action could increase inflation without affecting growth or unemployment. For monetarists, the government’s most important job is to keep the total amount of money in circulation expanding at a slow, constant rate.

Which Approach Is The Main Driver of U.S. Economic Policy?

Modern American economic policy involves a combination of Keynesianism and Monetarism, an approach often referred to Neoliberalism. In recent years, the federal government has acted aggressively to stimulate the economy during the financial crisis of 2008 and the COVID-19 pandemic. These efforts sent money directly to individuals and businesses, and paid for large infrastructure, healthcare, and education programs designed to increase economic growth, address income inequality, and increase quality of life in American communities. On a more limited basis, there has also been an emphasis on less government regulation of businesses, few regulations on trade, and efforts to control government spending.

How Do Other Nations Determine Their Economic Policies?

Economic policies in other nations resemble the US in that they combine Keynesian and Monetarist measures. However, the specifics vary across nations. For example, the European Union initially followed austerity measures during the 2008 financial crisis, which aimed at reducing public spending and fiscal deficits. However, in response to the COVID-19 pandemic, the EU implemented large-scale fiscal stimulus packages and increased government spending to support economic recovery. In countries like Germany and South Korea, a more balanced approach has been adopted, combining free-market principles with strong social welfare systems and targeted government intervention in strategic industries.

How Much Control Do Policy-Makers Have Over Economic Conditions?

Economic activity fluctuates over time — these patterns of economic activity are called the business cycle. The cycle consists of periods of economic expansion where Gross Domestic Product (GDP) increases and contractions where GDP decreases. GDP declines generally happen when demand for goods and services fall due to reduced demand, increased unemployment, high inflation, or a combination. Economic theory suggests that expansion is the natural state of the economy and that recession only occurs when unexpected events, or economic shocks, disrupt these factors. Shocks can include war that increase oil prices or pandemics that shut down supply chains and increase unemployment.

The remedy, according to Keynesians, is government intervention to mitigate the impact of economic shocks. As noted earlier, the federal government acted to stimulate the economy during both the Financial Crisis of 2008 and during the COVID pandemic of 2020-2022. These efforts included tax cuts, direct payments to individuals and businesses, and increased levels of government spending on infrastructure and other programs. Such spending directly increases our national debt and can lead to inflation which was seen in late 2021 into the first half of 2023 in the United States.

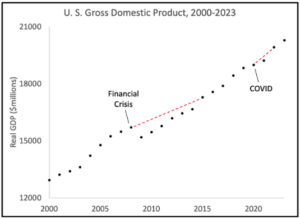

Did these efforts work as intended? The record is mixed, reflecting how hard it is to determine the appropriate policy response to an economic shock. The figure below shows real GDP (controlling for inflation) in the US for 2020-2023. The Financial Crisis and COVID pandemic are noted on the chart.

As the chart shows, the Financial Crisis caused a noticeable decline in GDP from 2008 to 2009. Moreover, while GDP resumed its upward trend in 2009, the gap between actual GDP and the trend in place prior to the Crisis did not close until several years later. Thus, while the government’s stimulus measures may have prevented a sharper decline in GDP, it did not eliminate the economic damage caused by the Crisis.

In contrast, it is hard to see the decline in GDP caused by COVID – it is fairly small, and the gap between actual and trend is closed almost immediately. It is likely that the much larger amount of COVID assistance was effective in responding to the economic shock. However, the larger stimulus likely had a cost in the form of higher levels of inflation in 2021-2023 (for details, see our policy memo on Inflation listed in the Further Reading section).

Two insights can be drawn from the government’s responses to the Financial Crisis and the Covid pandemic. First, it is difficult to determine how much stimulus is enough – in the case of the Financial Crisis, one argument is that the government did not do enough to mitigate the impact of the shock. However, in the case of COVID, there is an argument that the stimulus was too large and generated unwanted side effects (inflation).

Second, the argument from believers in Monetarist/Laissez Faire policy-making that the economy would recover faster without government intervention are untested in the recent past. Policy-makers simply do not know what would happen. Even somewhat unsuccessful interventions such as during the Financial Crisis may have prevented a far worse outcome. Regardless, analyzing the cause and effect of government spending over time can help lead to better decision-making for our policy makers.

Further Reading

Stupak M, J. 2022. Introduction to U.S. Economy: Fiscal Policy. Congressional Research Service, accessed 4/15/23, available at https://crsreports.congress.gov/product/pdf/IF/IF11253

Sheiner, L., Campbell, S., Kovalski A. M., & Milstein, E. 2021. How pandemic-era fiscal policy affects the level of GDP. Brookings, accessed 4/16/23, available at https://tinyurl.com/2xsrrmf5

Policy vs. Politics Policy Memo: Inflation, available at https://policyvspolitics.org/inflation-what-you-need-to-know/, accessed 7/23/23

Sources

What Are The Main Approaches For Managing The Economy?

Jahan, S., Mahmud, A. S., & Papageorgiou, C. 2014. What Is Keynesian Economics?. Finance & Development, 53, accessed 4/30/23, available at https://tinyurl.com/yb84zxma

Levačić, R., Rebmann, A. (1982). The Theory of Economic Policy. In: Macroeconomics. Palgrave, London, accessed 4/30/23, available at https://doi.org/10.1007/978-1-349-86044-9_22

Jahan, S., & Papageorgiou, C. (2014). What is monetarism?. Finance and Development, 51(1), 38-39. https://tinyurl.com/mr4x2h6a

Stansbury, A., & Summers, L. H. (2020). The Declining Worker Power Hypothesis: An Explanation for the Recent Evolution of the American Economy. Brookings Papers on Economic Activity, 1-77, https://www.jstor.org/stable/48694930

Which Approach Is The Main Driver of Modem US Economic Policy?

Kuttner, R., & Bartel, R. D. (1991). Managing U.S. Economic Destiny. Challenge, 34(1), 18-26. http://www.jstor.org/stable/40721221

Stansbury, A., & Summers, L. H. (2020). The Declining Worker Power Hypothesis: An Explanation for the Recent Evolution of the American Economy. Brookings Papers on Economic Activity, 1-77, https://www.jstor.org/stable/48694930

Dwyer, R. E., & Wright, E. O. (2019). Low-Wage Job Growth, Polarization, and the Limits and Opportunities of the Service Economy. RSF: The Russell Sage Foundation Journal of the Social Sciences, 5(4), 56-76. https://doi.org/10.7758/rsf.2019.5.4.02

How Do Other Nations Determine Their Economic Policies?

Hogan, H. (2021). From Austerity to Neo-Keynesianism: the EU’s U-Turn. Studies: An Irish Quarterly Review, 110(440), 437-445. https://www.jstor.org/stable/27135634

Mellish, T. I., Luzmore, N. J., & Shahbaz, A. A. (2020). Why were the UK and USA unprepared for the COVID-19 pandemic? The systemic weaknesses of neoliberalism: a comparison between the UK, USA, Germany, and South Korea. Journal of Global Faultlines, 7(1), 9-45. https://doi.org/10.13169/jglobfaul.7.1.0009

Hogan, H. (2021). From Austerity to Neo-Keynesianism: the EU’s U-Turn. Studies: An Irish Quarterly Review, 110(440), 437-445. https://www.jstor.org/stable/27135634

Mellish, T. I., Luzmore, N. J., & Shahbaz, A. A. (2020). Why were the UK and USA unprepared for the COVID-19 pandemic? The systemic weaknesses of neoliberalism: a comparison between the UK, USA, Germany, and South Korea. Journal of Global Faultlines, 7(1), 9-45. https://doi.org/10.13169/jglobfaul.7.1.0009

Rodrik, D. (1996). Understanding Economic Policy Reform. Journal of Economic Literature, 34(1), 9-41. http://www.jstor.org/stable/2729408

How Much Control Do Policy-Makers Have Over Economic Conditions?

Wolla A, S. 2023. All About the Business Cycle: Where Do Recessions Come From? Federal Reserve Bank of St. Luis, accessed 4/16/23, available at https://tinyurl.com/ssh3kk5v

U.S. Bureau of Labor Statistics. 2023. Real GDP. Retrieved from FRED, Federal Reserve Bank of St. Louis, accessed, 4/16/23, available at https://fred.stlouisfed.org/series/GDPC1

De Soyres, F., Santacreu, A. M., & Young, H. 2022. Fiscal policy and excess inflation during Covid-19: a cross-country view. Board of Governors of the Federal Reserve System, accessed 4/16/23, available at https://tinyurl.com/yn5wufwj

Sheiner, L., Campbell, S., Kovalski A, M., & Milstein, E. 2021. How pandemic-era fiscal policy affects the level of GDP. Brookings, accessed 4/16/23, available at https://tinyurl.com/2xsrrmf5

Ball, L., Mankiw, N. G., Romer, D., Akerlof, G. A., Rose, A., Yellen, J., & Sims, C. A. 1988. The New Keynesian Economics and the Output-Inflation Trade-Off. Brookings Papers on Economic Activity, 1988(1), 1–82, accessed 4/17/23, available at https://doi.org/10.2307/2534424

De Soyres, F., Santacreu, A. M., & Young, H. 2022. Fiscal policy and excess inflation during Covid-19: a cross-country view. Board of Governors of the Federal Reserve System, accessed 4/16/23, available at https://tinyurl.com/yn5wufwj

This policy brief was researched and drafted in March-April 2023 by Policy vs. Politics interns Nithin Krishnan, Shelby Richardson (Rosa Nice), and Zul Norin, and revised by Research Director Dr. William Bianco